What a difference a year makes. Miami’s fledgling condo comeback of early 2012 has evolved into a full-blown stampede, with developers racing to acquire developable sites and launch new projects and international buyers snapping up units ‘sight unseen.’

In the latest example, Rilea Group’s The Bond at 1080 Brickell, secured 130 condo reservations in four hours on the very night of the project’s launch (see the Miami Herald’s report below).

With more than 25 new condo developments underway in the urban core alone (more than 80 in South Florida!), questions have surfaced about whether this is another bubble.

With more than 25 new condo developments underway in the urban core alone (more than 80 in South Florida!), questions have surfaced about whether this is another bubble.

The answer is simple: this cycle could not be more different than the last building boom. Why, you ask?

Cash remains king: The vast majority of buyers are purchasing their units with all-cash payments. In fact, required down payments for many condos are in the neighborhood of 50%.

Rental demand on the rise: Lingering domestic economic volatility, tightened bank lending, and surging demand for urban living have resulted in record-level demand for downtown Miami rentals. This means that the condos purchased are likely to be occupied and revenue-generating early-on, reducing the risk of default.

High barriers to entry: Scarce lending on the part of financial institutions means the market favors well-capitalized developers and buyers. Unlike the last building boom, these condos are being built and purchased with equity.

Downtown goes uptown: The arrival of luxury retail in Miami’s urban core — at Brickell CitiCentre and in the Design District — is proving to be a big draw for condo buyers, especially Latin Americans who can’t get enough Prada bags and Louboutin heels.

X-factor: Lastly (and just as important) is Miami itself. The Magic City’s brand was an unproven commodity in the early 2000s. Today, Miami is a global destination for tourism, business, culture and investment.

X-factor: Lastly (and just as important) is Miami itself. The Magic City’s brand was an unproven commodity in the early 2000s. Today, Miami is a global destination for tourism, business, culture and investment.

Value and security: Couple this appeal with the fact that Miami real estate is a ‘value’ compared with other major cities, and you begin to see why condos are flying off the shelves. And besides, is there a better long-term investment than US real estate?

![]()

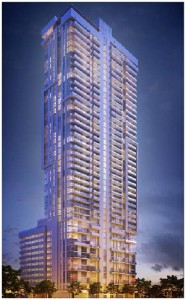

Ojeda Launches Luxury Brickell Condo

Miami developer Alan Ojeda’s Rilea Group expects to begin construction at 1080 Brickell Ave. as early as August on a 44-story, 323-unit luxury condominium called The Bond.

The project drew strong interest at a pre-construction sales event Wednesday evening, tallying more than 130 reservations to purchase units on the spot.

Ojeda, a savvy developer with a reputation for simplicity and quality, has built a variety of high-profile residential and commercial projects in the area. They include the 1450 Brickell office tower, where the developer is headquartered, known for its hurricane-resistant features like stronger glass and a back-up generator. Other projects include One Broadway apartments and the Sabadell Financial Center at 1111 Brickell Ave.

“I’m looking for a very urban, New York/London feel. Not flashy, but solid, sound elegance,” Ojeda said. He has worked with The Bond’s architect, Nichols Brosch Wurst Wolfe & Associates, and its general contractor, Miami-based Coastal Construction, on four projects. “We have a team of proven experts,’’ said Ojeda, who is owner and CEO of Rilea Group.

Prices will run from about $300,000 to more than $1 million for units ranging from studios to three bedrooms. Prices will average $500 to $600 a square foot.

The building will include two pools, a fitness center and spa, 24-hour valet parking, a 595-space garage, a children’s area and business center. While it is nearly all residential, it will have a 5,000-square-foot restaurant in the lobby.

Building approvals for The Bond are already in place. Ojeda had planned to build a condominium on the site in 2007 but shelved plans as the market soured. He sold the land to MDR Tole-do LLC, a unit of Madrid, Spain-based MDR Americana, a private equity firm, which also has offices at 1450 Brickell and is an equity partner in the project.

The 1080 Brickell site, tucked between Brickell Avenue and South Miami Avenue, is surrounded by other condominium sites. Related Group is building 1100 Millecento and a hotel/ condominium project that has signed the hip SLS brand.

Other nearby development sites are in play, including the Capital at Brickell site at 1420 S. Miami Ave. and the Brickell Flatiron site at 1001 S. Miami Avenue, according to Peter Zalewski, principal at Bal Harbour-based Condo Vultures, which closely tracks the South Florida condominium market.

“If there is one area that has the potential to be overbuilt, it’s this area here,” Zalewski said. “I’m going as far as calling it ‘the condo triangle.’ ”

Alicia Cervera Lamadrid, managing partner of Cervera Real Estate, which is overseeing pre-construction sales, said the project’s prestigious Brickell address combined with its central location near restaurants and shopping and the developer’s pedigree are a magnet for sales, as is the nearby Metromover and trolley service.

Cervera Lamadrid said the current financing model for pre-construction condominiums – which requires unit buyers to pony up 50 percent of the price during the construction process and the balance at closing – helps buffer the market from overheating.

“I think we’re all very protected by the payment structure. There is so much money on the table,” Cervera Lamadrid said. “We know ‘If you build it, they will come.’ We’re going to have a vibrant urban core.”

See More Blogs

See More Blogs

Comments