![]()

By Ben DiPietro

A regulator in India in January banned affiliates of PricewaterhouseCoopers from auditing listed companies for two years. The ban is punishment for the firm’s failure to detect a billion-dollar fraud at Satyam Computer Services Ltd., an outsourcing company. PwC was in charge of checking Satyam’s accounting in 2009 when Satyam’s founder admitted he padded revenue by close to $1 billion by inflating sales and forging bank documents.

PwC said its accountants were duped, and said it is confident it can reverse the order in court.

“The SEBI [Securities and Exchange Board of India] order relates to a fraud that took place nearly a decade ago in which we played no part and had no knowledge of,” PwC said in a statement. “We have however learnt the lessons of Satyam and invested heavily over the last nine years in building a robust and high-quality audit practice.”

Three crisis management experts analyze how well PwC communicated during this crisis.

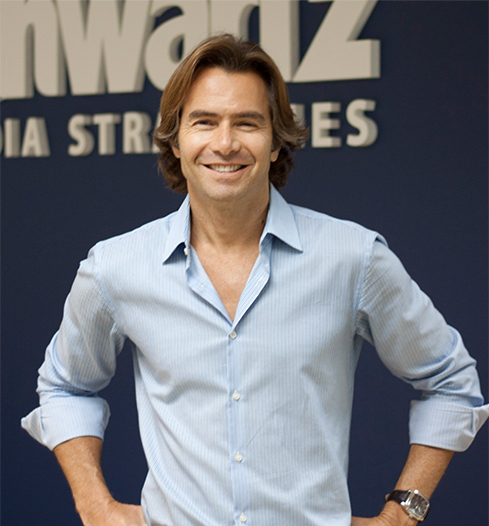

Tadd Schwartz, president and chief executive, Schwartz Media Strategies:

“The central role of any auditor is to ensure a clean bill of financial health while uncovering instances of error, mismanagement or fraud, so it is somewhat disingenuous PwC is feigning ignorance. PwC walks a fine line in its response. By distancing itself from Satyam’s wrongdoing, the firm protects its legal position but undermines the very reason it was hired in the first place.

“PwC claims it has ‘learnt its lessons’ following the mishap, but its stance comes off as defensive and reactive, given the government’s findings. The firm would have been better off avoiding the remorseful language and focusing solely on what lies ahead. [That should be] voicing confidence the court’s decision would be reversed, while reinforcing the investments it has made in creating…rigorous and sophisticated audit infrastructures, with specific examples to back up its claims.”

See More Blogs

See More Blogs

Comments