Schwartz Media Strategies has partnered with Hispanic consumer trend research firm ThinkNow Research to share high quality research on the US Hispanic consumer. The latest report, Hispanic Travel Trends 2015, delivers actionable and meaningful insight on the nation’s fastest-growing demographic. We share highlights from the report below.

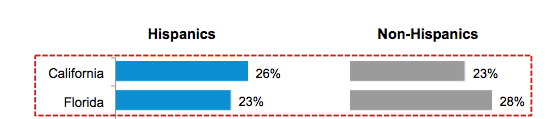

Florida tops the list of destinations for U.S. Hispanics to visit next year.

A new national study by ThinkNow Research finds that Florida is forecasted to be the second most visited destination in America for Hispanic travelers in the next twelve months. The report, which surveyed 1,014 people between the ages of 18 and 65, focused on international and national destination preferences, travel habits and upcoming trends.The Sunshine State’s appeal to the fastest-growing demographic provides a built-in advantage going into 2016 after an already record-breaking year.

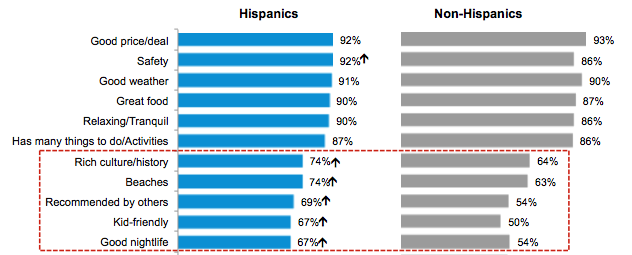

Hispanics place more importance on culture, beaches and kid-friendly activities when choosing a destination.

Florida’s theme parks and beaches give the state an advantage among Hispanics, who are more likely to visit family-friendly destinations than non-Hispanics. Price, weather, cuisine, nightlife and cultural offerings are among the strongest factors in vacation planning for Hispanics. This leaves Florida, and particularly the state’s southern and central regions, in prime position thanks to their thriving hotel markets and multitude of cultural options for families.

“Downtown Miami is an increasingly popular destination around the world, but our domestic visitor base is often overlooked and Hispanics account for one of the fastest-grownging segments of that group,” explains Alyce Robertson, Executive Director of the Miami Downtown Development Authority. “Our hotels, restaurants, shops, cultural venues, walkable streets and proximity to South Florida’s best beaches give downtown and leg up on other destinations across the state.”

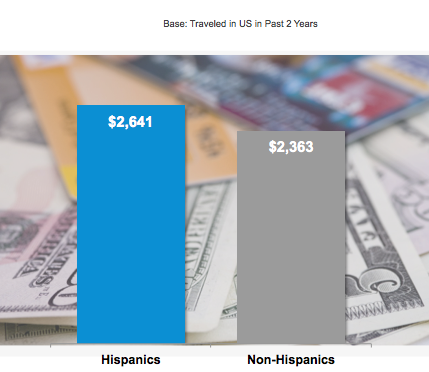

Hispanics spend nearly $300 more than Non-Hispanics on vacations.

According to the report, Hispanics spent an average of $2,641 on their last vacation to a US destination which was nearly $300 more than Non-Hispanics.

41% of Hispanics opt for midscale hotels

When it comes to choosing accommodations during their trips, 41 percent of Hispanics opt for mid scale hotels, 34 percent for economy hotels, 26 perfect for luxury hotels and resorts, 18 percent of bed and breakfasts and 10 percent for both campground/RV parks and timeshare/condos/vacation rentals.

Recognizing these preferences, foreign hotel owners and operators are entering the Florida market at a fast pace. Atton Hotels, a Latin American chain, recently announced plans to enter the US market with a 275-room hotel in Miami’s Brickell Financial District. “Atton has built a loyal customer base in Latin America, so when the decision to enter the US market was made, Miami was the natural entry point. Our hotels will cater to families and business travelers alike, and we think our Latin American roots will be appealing to all and especially Hispanic travelers,” says Francisco Levine, CEO of Atton Hotels.

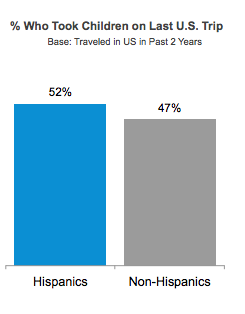

Hispanics are more likely to travel with children.

52 percent of Hispanics report traveling with children during their last vacation, compared to 47 percent of Non-Hispanics. This is prompting hotel and resort developers to tailor their properties, room configurations and marketing campaigns to extended families. Two examples are the new MargaritaVillage and Reunion megaresorts in the Orlando area, which will feature vacation homes comprising of as many as 12 bedrooms.

“Multigenerational families want to stick together at an affordable price point while traveling, so we’re accommodating these groups at our MargaritaVillage and Reunion resorts with large, amenity-rich homes that reduce the cost per person, per night by as much as 50 percent or more,” says Art Falcone, CEO of Encore Capital Management, which is developing the two Central Florida properties.

ThinkNow’s 2015 “Hispanic Travel Trends” report polled 1,014 people during April 2015 and was weighted between gender balance, region and primary language spoken at-home among participants.

See More Blogs

See More Blogs

Comments